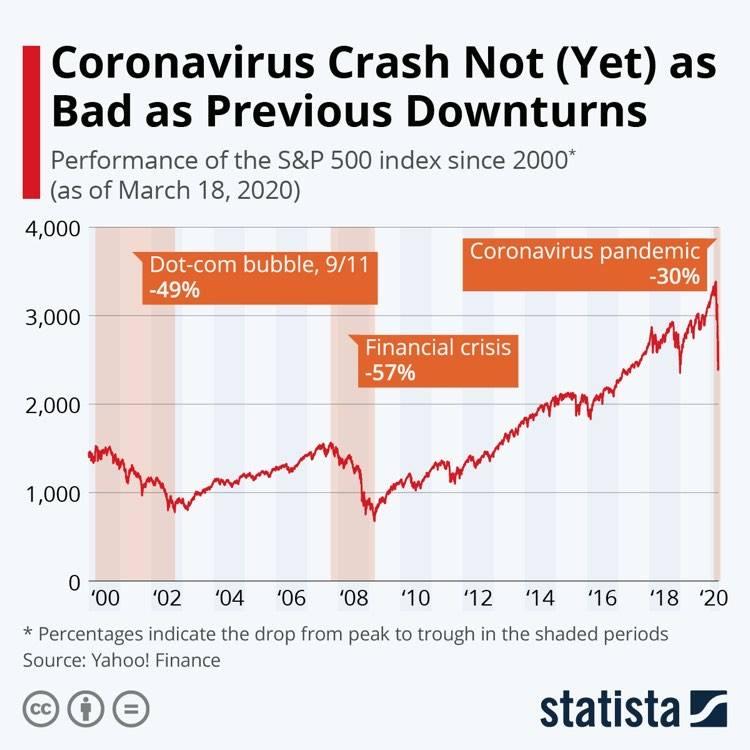

The U.S. S&P 500 touched its historic high of nearly 3,400 points this year. A month later, at 2,400 points, it was 29% lower.

The coronavirus-induced decline that caused global panic due to an almost complete halt to economic activity still shows no signs of subsiding. The collapse in the price of oil on commodity exchanges has further complicated the embarrassing situation. The uncertainty over the ultimate consequences in terms of people’s lives, as well as economic losses, is best reflected in the historical volatility of financial markets. Stock indexes have recorded a 20% drop since the last peak, marking the entry into the bear market. Volatility is also huge, and it is best seen that the stock markets have recorded within the daily change of over 4% in the last 8 days in a row, and in some days around 10% in both directions. Stock index of the Zagreb Stock Exchange, Crobex, from historic 19.02. until the market closes on 19.03. In 2009, it lost 32.3%, and fell to levels at the peak of the financial crisis in 2009. With this, the market capitalisation of all shares on ZSE has dropped from HRK 151 billion to 124 billion. The global panic is historic, but this crisis has not reached the scale of the previous ones seen from the accompanying graph.

balkantimes.press

Napomena o autorskim pravima: Dozvoljeno preuzimanje sadržaja isključivo uz navođenje linka prema stranici našeg portala sa koje je sadržaj preuzet. Stavovi izraženi u ovom tekstu autorovi su i ne odražavaju nužno uredničku politiku The Balkantimes Press.

Copyright Notice: It is allowed to download the content only by providing a link to the page of our portal from which the content was downloaded. The views expressed in this text are those of the authors and do not necessarily reflect the editorial policies of The Balkantimes Press.