Thanks to the power of compound interest, the earlier you start investing, the easier it is to build wealth. And while we can’t go back in time and start saving earlier ourselves, we can help our children by starting to invest on their behalf when they’re young.

If you’re a parent or planning to become one soon, you can take advantage of compound interest to set your child up for financial success.

“If given the choice between 20 years experience and expertise vs. 20 years extra time for compounding, I’d take the time,” Josh Brown, CEO of investment advisory firm Ritholtz Wealth Management, said in a recent video on his YouTube channel.

More from Grow

3 books to help teach kids about money while they’re still young

3 fun ways parents can teach kids about investing

Retirement calculator: How much money you need to have saved

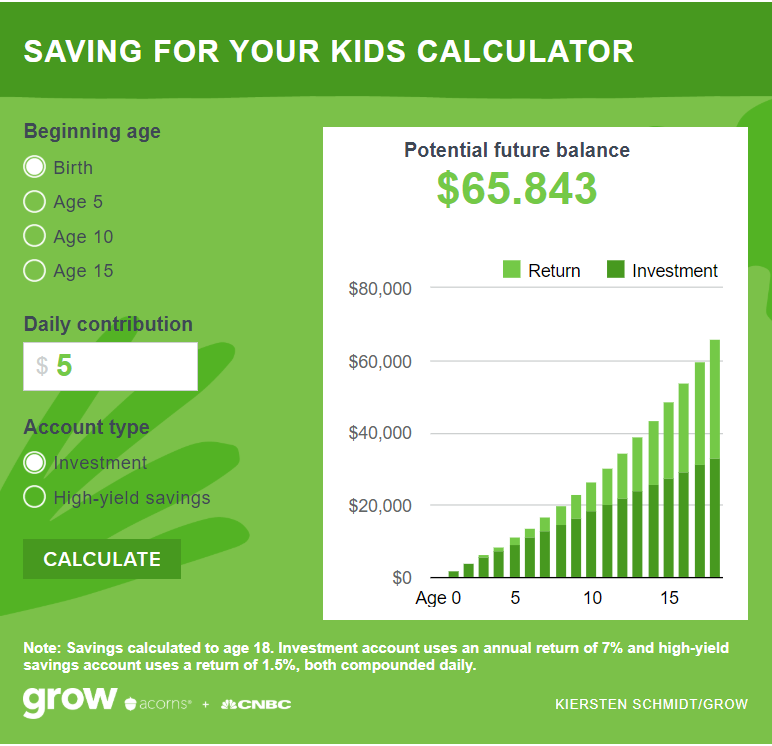

Try our calculator below to see how much money your child could have by age 18 based on how much you invest and when you start. If you want see in more detail how time can help you grow your money, you can use our compound interest calculator.

The benefits of investing on behalf of your child

Because of compounding, time can be more valuable than money, so even a little money can go a long way. For example, investing just $1 per day from birth can lead to more than $13,000 by the time your child turns 18 and may be ready to go to college or to start a career.

If you wait until your child is 5 years old to make the same investment, that total falls by almost half, to just $7,700, even though you’ve invested just $1,800 less.

This calculator tells you how much money your kids could have at 18 if you invest for them now. (via @CNBCMakeIt) https://t.co/95ZkcKjIvI

— CNBC (@CNBC) August 8, 2020

So, while setting up a savings account for your child has perks, you will likely see a far greater return on your money if you put your funds in an investment account. Your options include a tax-advantaged 529 plan, “the primary vehicle of choice” for saving for college, according to Justin Halverson, a financial advisor at Minnesota-based Great Waters Financial, and a custodial brokerage account.

Currently, the best rate offered on a high-yield savings account is around 1%, while the annualized annual return of the S&P 500 over the past 50 years is about 10%.

Even if the stock market doesn’t produce annual returns that strong over the next two decades, you are still likely to make more money off an investment than you would from a savings account.

You can also use the account to help teach your child the importance of investing for the future. According to a report last year from Morning Consult, half of adults between the ages of 18 and 34 are not saving for retirement at all, and only 39% of those who are saving started in their 20s. By providing your children with a solid foundation in financial topics, you can give them a head start on reaching money goals throughout their lives.

If your children wind up not needing the money for educational or early career expenses, they could also benefit from leaving the investments to grow. A $5 daily investment from birth through age 18 could be worth $2 million by age 67. In other words, your child could eventually become a millionaire without even investing any of their own money.

CNBC / Balkantimes.press

Napomena o autorskim pravima: Dozvoljeno preuzimanje sadržaja isključivo uz navođenje linka prema stranici našeg portala sa koje je sadržaj preuzet. Stavovi izraženi u ovom tekstu autorovi su i ne odražavaju nužno uredničku politiku The Balkantimes Press.

Copyright Notice: It is allowed to download the content only by providing a link to the page of our portal from which the content was downloaded. The views expressed in this text are those of the authors and do not necessarily reflect the editorial policies of The Balkantimes Press.