This text is intended for all of us, especially those who think that the Yugoslav economy during the Tito period was built on a stable foundation. If we look at and analyze the economic indicators, we must admit that the idea of the robustness of the Yugoslav economy was an illusion and that the “well-being” of which many Yugo-nostalgics speak today1 was borrowed at the expense of future generations. Those generations now, in addition to paying the bills for the destructive wars of the 1990s and the interventionist economic policies of the successor states of the former Yugoslavia, are also paying for the collapse of the unsustainable economic system of socialist Yugoslavia.

The first sign that the robustness of the Yugoslav economy was an illusion appeared immediately after Tito’s death. The eighties were marked by the postponement of the beginning of repayment of Yugoslavia’s foreign debt due to the financial weakness of the economy. In 1991, Yugoslavia received about $ 20 billion in debt. Previously, the International Monetary Fund reduced its total claims by 1.8 billion3 because the country simply had no means of repayment or interest, let alone principal. What preceded this condition? It was preceded by several decades of building an economy whose structure was such that its survival depended on a steady increase in external debt – the economy of the addicts.

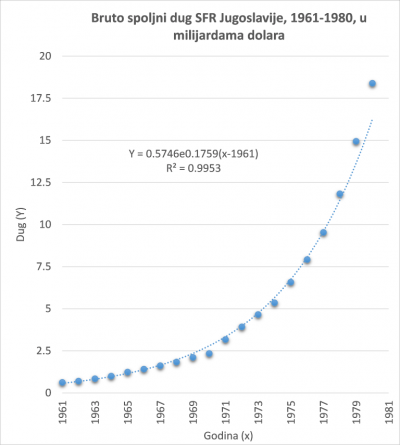

The chart below shows the total debt of Yugoslavia from 1961 to 1980.4 and a line that can approximate the trend of total debt. The line is exponential in shape and fairly faithfully approximates actual debt in 1961-1980. Following this trend, total debt increased by about 17.6% each year over that twenty-year period. If this growth rate continued beyond 1980, total debt today would be about $ 6 billion. When we consider that today the total annual gross domestic product (GDP) of all former Yugoslav republics is together about $ 200 billion, it is clear to us what the astronomical amount of debt is. This also makes it clear to us that debt growth recorded between 1961 and 1980 was simply unsustainable.

These numbers put the proper context for actually increasing the debt of all former Yugoslav republics from about $ 20 billion in 1980 to about $ 150 billion today. It is true that $ 150 billion is many times more than $ 20 billion, but let’s keep in mind that, given the dollar’s decline, $ 20 billion in 1980 and $ 100 billion in 2014 have roughly equal economic power. Thus, in real terms, the external debt of the former Yugoslavia has increased by about 50% from 1980 to the present. While we may all prefer that figure to be smaller, compared to the doubling of external debt every three or four years before 1980, it represents a dramatic decrease in growth. This, of course, does not mean that the current indebtedness of the former Yugoslav republics is favorable and that the economic policies of these countries are in good shape. It just means that it was unrealistic to hope that the Yugoslav debt could stay at $ 20 billion without serious structural changes and spending cuts.

Although these numbers offer a potential explanation for the collapse of the Yugoslav economy in the 1980s, exponential debt growth alone would not necessarily lead to a collapse if the purpose of borrowing was to invest in projects that would bring increased productivity and thus successfully repay debt in the future. Unfortunately, this was not the case for the former Yugoslavia.

The fact that the Yugoslav economy has spent at least twenty years at a rate of debt growth of over 17% annually suggests that the structure of that economy was also shaped in such a way that the continued survival of the economy depended on a future increase in debt. In order to understand why Yugoslav debt grew sharply and why it was non-performing, it is necessary to analyze the trade balance and Yugoslav productivity indicators chronologically.

The trade balance is a macroeconomic indicator of the size of imports and exports of a country. If the trade balance is close to zero, it means that imports and exports are approximately equal. If the trade balance is positive, that country exports more than it imports and we say that there is a trade surplus, and if the balance is negative, imports are higher than exports and that country is in trade deficit.

When a country’s economy is in trade surplus, the foreign currency (with which foreigners pay for the products of that country) accumulates in the exporting country. On the other hand, foreign currency (which pays for imports) drains from a country whose economy is in a trade deficit. Countries that constantly have a negative trade balance are borrowing from foreign lenders at the same time to make up for the lack of foreign currency. It is not difficult to see why this condition is unsustainable in the long run, ie. it is only sustainable as long as the foreign creditors want to lend money to the borrower.

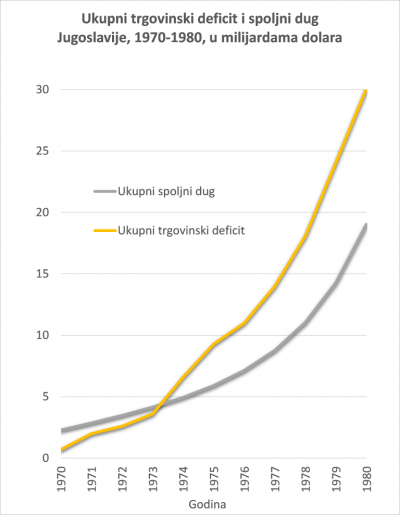

If we look at the total Yugoslav trade deficit during the 1970s, we see that it increased rapidly between 1970 and 1980. Moreover, that deficit grew even faster than Yugoslav foreign debt. Part of that difference was covered by remittances from Yugoslav emigrants. For example, emigrants’ total remittances totaled $ 1.3 billion in 1971, and $ 2.1 billion in 1972.5 However, even the inflow of foreign currency through foreign credits and remittances of emigrants was not sufficient to cover all trade deficits and prevent foreign currency outflows from Yugoslavia.6

Measured as a percentage of GDP, Yugoslavia’s total foreign trade deficit between 1970 and 1980 increased from just below 10% to about 50% of GDP.7 What is worrying about this is not the figure of 50% of GDP itself, but rather the fact that Yugoslavia recorded an increasing trade deficit year on year relative to GDP. This is another indication that the structure of the Yugoslav economy itself was such that the stability of the entire economy depended on the inflow of foreign funds for which there was no coverage in domestic production.

The structure of the Yugoslav trade deficit was such that mainly imported materials such as oil and raw materials were imported.8 Such a structure of production does not promise an increase in productivity in the future that would cover the trade deficit of the past and thus be able to pay off debts. Moreover, although the total volume of production at the level of the economy of Yugoslavia was increasing as more resources were used, productivity per unit of invested resources9 in most Yugoslav industries declined during the 1960s and 1970s. With such reduced productivity, the chances of a successful loan repayment in the future become slim.

The production structure of borrowing money to buy raw materials ceases to be viable when the source of the loan dries up, which in the case of Yugoslavia happened in the early 1980s. The Yugoslav economy was then left without external “fuel” and this became noticeable over the next decade, marked by the delay in repayment of external debts. Not only did the Yugoslav economy lack the capacity to repay its existing debts, but its very capacity to function on an unprecedented scale depended on new borrowings. Yugoslav GDP has stagnated since 1980, and has declined since 1986.

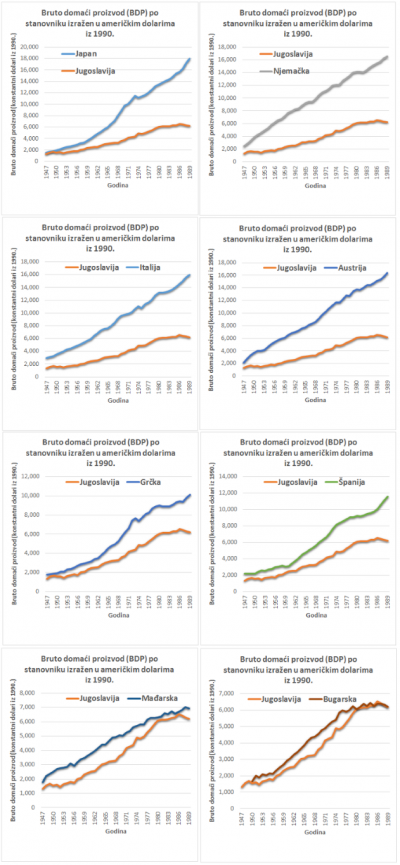

These indicators suggest that the story we often hear about how the former Yugoslavia heroically “rose from the ashes” after World War II is incomplete. First, it is not clear how heroic this uplift has been, especially if it is indebted to unsustainable borrowing. Second, it’s hard to give some credit for that story unless we know how some other countries “rose from the ashes.” Therefore, let us compare the GDP per capita of some countries which, at the end of the 1940s, had approximately the same GDP as Yugoslavia of that time.

Let’s see what historical data tells us. We are told that all the countries shown here, except Hungary and Bulgaria, had significantly higher GDP growth per capita than Yugoslavia between 1947 and 1989. So perhaps Yugoslavia rose heroically from the ashes, but Japan seems to have , Germany, Italy, Austria, Greece and Spain rose much more heroically from that ash.

Even considering that Western European countries received US aid worth over $ 12 billion under the Marshall Plan, 11 that figure pales in comparison to the $ 47 billion received by Yugoslavia as reparations for World War II war damage , 12 in the form of industrial equipment and in monetary form. In addition, there is strong evidence13 that the role of American interests represented in the politics of Truman and Eisenhower in Yugoslavia in the aftermath of World War II was similar to that of Western European countries. This role was to provide political and economic support to the regime as a counterweight to the “hard” socialism of the Soviet Union and its European satellites. Therefore, we cannot attribute the much faster growth rate of Western European economies to disproportionate US aid relative to Yugoslavia.

Hungary and Bulgaria, on the other hand, show a similar slow growth in GDP as Yugoslavia. Apart from the fact that, unlike the other countries presented here, Hungary and Bulgaria had a similar economic system as Yugoslavia, a more detailed explanation of the differences in the rate of “ash rising” is a topic for special analysis.

If we look at other economic indicators14 such as household wages, inflation and unemployment, the situation has not been rosy in the last ten years of Tito’s rule. Receipts declined sharply in the late 1970s despite pumping huge amounts of foreign assets into the country. Annual inflation is measured in double digits, and several years before Tito’s death, it accelerates to 40% annually. The unemployment rate, despite the departure of more than 1.1 million (or 20% of the workforce) 15 Yugoslavs for temporary work abroad, rose from just under 7% to 12% from 1970 to 1980. Such rise in unemployment and the rate of economic emigration would be characterized in the economic literature as a sign of a deep recession. Thus, the Yugoslav economy was in a dire state in the late 1970s, but this was masked by an increase in foreign loans of epic proportions combined with an increase in economic emigration.

It may be time to revise our beliefs about the “heroic successes” of our former homeland and acknowledge that despite the steady growth in foreign currency inflows in the form of unsecured loans, remittances of the millions of Diaspora, and politically motivated US economic assistance, the Yugoslav economy has seen modest growth. But even this modest growth was unsustainable without continued foreign assistance. What happened in the eighties and nineties is merely a revealing of the real state of the Yugoslav economy. Just as a chronic alcoholic has to deal with the reality of his addiction, so, at times, we have to face the reality of the inability of the Yugoslav economy to function without external doping.

Reference:

Bili smo mala Amerika

Serbia Overtakes Croatia in Economic Freedom

Mojmir Mrak, Debt Conversions in Yugoslavia, OECD Development Centre, Working Paper No. 54

Mate Babic and Emil Primorac, Some Causes of the Growth of the Yugoslav External Debt, Soviet Studies, Vol. 38, No. 1 (Jan., 1986), pp. 69-88

David A. Dyker Yugoslavia: Socialism, Development and Debt

David A. Dyker Yugoslavia: Socialism, Development and Debt

Macroeconomics of Yugoslavia, 1970-1990

Razvoj privrednih djelatnosti u SFR Jugoslaviji

Socialist Yugoslavia (1945 – 1992) as a Failed Response to Mises and Hayek: A Survivor’s Experience

Historical Statistics for the World Economy: 1-2003 AD

Marshall Plan

World War II reparations towards Yugoslavia

Lorraine M. Lees, Keeping Tito Afloat – The United States, Yugoslavia, and the Cold War

Mit o zdravoj jugoslovenskoj ekonomiji

Economy of the Socialist Federal Republic of Yugoslavia

balantimes.press

Napomena o autorskim pravima: Dozvoljeno preuzimanje sadržaja isključivo uz navođenje linka prema stranici našeg portala sa koje je sadržaj preuzet. Stavovi izraženi u ovom tekstu autorovi su i ne odražavaju nužno uredničku politiku The Balkantimes Press.

Copyright Notice: It is allowed to download the content only by providing a link to the page of our portal from which the content was downloaded. The views expressed in this text are those of the authors and do not necessarily reflect the editorial policies of The Balkantimes Press.