Chairman Mark Tucker and chief executive Noel Quinn are juggling the demands of HSBC’s Asian business, where the bank makes 90 per cent of its pre-tax profits and has ambitions to invest hundreds of billions of dollars in mainland China, with its US dollar-denominated balance sheet and London-based headquarters and regulator. The backlash over the security law — which sparked a new wave of street protests and caused the US to threaten reprisals — comes only two months after HSBC made the contentious decision to cancel its dividend for the first time in 74 years, bowing to pressure from the Bank of England. Retail shareholders in Hong Kong, who own about a third of the bank, threatened to sue for lost earnings and it reignited a debate over whether HSBC should move its domicile back to Asia from London. The dividend decision jarred with some executives and board members, who felt that money earned in Asia was being forcibly withheld to support British businesses through the Covid-19 crisis.

Both incidents have revealed deepening splits within the company, whose share price has fallen by more than a third in the past 12 months. “From the time you join HSBC, it is repeated over and over again, ‘We are a multipolar business, we do not take sides, we are apolitical, we are guests in every country’,” said an executive at the bank. “But the complexities of HSBC mean we get caught out more than anyone else,” the executive added. “We are trying to thread the needle with half of Hong Kong society versus the other half. Half our shareholders are still western and the rest are in Asia.”

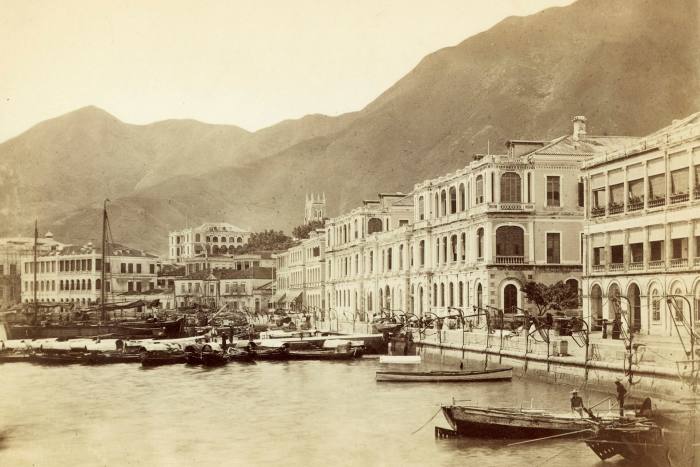

The lender remains reliant on Hong Kong, where it was founded by British merchants in 1865. More than half of its group profits come from the semi-autonomous city state, with another 13 per cent from mainland China. Furthermore, HSBC is set to become even more dependent on Asia as a widespread restructuring could see its lossmaking US retail arm closed or sold and deeper cuts in Europe. Another executive said the main issue at stake was not east-west tensions, but rather “pressure from China versus the potential backlash from Hong Kong itself, given that the entire economic value of HSBC is tied to it”. “If you alienate the Chinese authorities it will jeopardise the future of the bank, but if you alienate Hong Kong you take a risk where all the money is currently made,” the executive added. “The view taken by Mark [Tucker] is that there was too much political risk not to support Chinese authorities, they are the long-term future of Hong Kong, forget everything else,” he said.

Standard Chartered’s chief executive, Bill Winters, faced a similar “Hobson’s choice” about supporting the security law, said a top manager at that bank. “Minus our Hong Kong operations, StanChart is non-existent. Our usual approach is to aggressively sit on the fence as these are no-win issues, but in the past it has not been a ‘you are with us or else’ situation.” In the event, StanChart issued a statement backing the security law. Jonathan Pierce, an analyst at Numis in London, said: “As the relationship between the US and China deteriorates, there is a risk of these banks becoming political footballs.”

On Tuesday, US Secretary of State Mike Pompeo criticised HSBC for its “corporate kowtow” to Beijing and said China’s “coercive bullying tactics” showed the need to avoid overreliance on the country. The support for Beijing has rankled with some staff at both banks. Easy Kwok, head of Hong Kong Financial Industry Employee General Union, said: “HSBC and StanChart should clarify why they are betraying Hong Kong people while most of the governments from western world are against this evil law.” Western institutional investors, increasingly focused on socially responsible practices, have also voiced their concerns. “We are uneasy at the decisions of HSBC and StanChart to publicly support the proposed new national security law without knowing the details or how it will operate in practice,” said David Cumming, chief investment officer for equities at Aviva Investors, a top-20 shareholder in both banks. “If companies make political statements, they must accept the corporate responsibilities that follow,” he added. “We expect both to confirm that they will also speak out publicly if there are any future abuses of democratic freedoms connected to this law.”

However, another of HSBC’s largest shareholders said he was not surprised by the decision because fiduciary interests will inevitably lead it to side with Beijing. “Ultimately, this is how it will play out and China knows it,” the person said. “The fact is, it [greater Chinese control] was going to happen anyway, now or in 27 years. It also reflects very sadly the decline of UK power.” HSBC’s relationship with China — which has been under increasing pressure for years — has only grown more fraught amid the diplomatic row over China’s top telecoms equipment maker, Huawei. The bank received a shot across its bow after Beijing blamed executives for providing information to US prosecutors that led to the arrest of Huawei’s chief financial officer, Meng Wanzhou, in Canada in December 2018. Apologies from former chief executive John Flint to the Chinese ambassador in London in January eased the strain. However, a few months later The Global Times, a Chinese state-run English-language tabloid, reported that HSBC could be included on China’s forthcoming “unreliable entity” list in response to its “unethical” handling of the Huawei affair.

One senior figure at the bank maintains that despite being placed in an “unenviable position” by the spat, relations with Beijing remain “good and strong” and managers remain in close contact with the Chinese leadership at the most senior levels. While occasionally being placed in the “sin bin”, Hong Kong and greater China remain the priority for future investment. Others painted a more pessimistic picture of HSBC’s current predicament. “Morale and spirits are pretty low . . . everything that could have gone wrong has: a collapse in rates, the dividend cancellation, Covid and the leadership struggle played out badly in public,” said one of the executives spoken to by the Financial Times. “HSBC has become a tense political organisation.”

FINANCIAL TIMES / Balkantimes.press

Napomena o autorskim pravima: Dozvoljeno preuzimanje sadržaja isključivo uz navođenje linka prema stranici našeg portala sa koje je sadržaj preuzet. Stavovi izraženi u ovom tekstu autorovi su i ne odražavaju nužno uredničku politiku The Balkantimes Press.

Copyright Notice: It is allowed to download the content only by providing a link to the page of our portal from which the content was downloaded. The views expressed in this text are those of the authors and do not necessarily reflect the editorial policies of The Balkantimes Press.