M&A trends are showing signs of a rebound; expect a jump in deals by year-end. Dealmakers are accustomed to facing uncertainty, but the scale and speed of COVID-19 sent shockwaves through the global economy and the mergers and acquisitions (M&A) market.

We adapted to the challenges and the changes in ways of living and working. As business went largely virtual, so did deals.

The global fiscal stimulus packages provided by governments to counter the economic downturn have now topped US$10 trillion and triggered strong rebounds across practically every financial market.

The acceleration of the digital economy is forcing companies and dealmakers to rethink strategy and will fuel M&A opportunities.

Brian LevyGlobal Deals Industries Leader, Partner, PwC US

Markets recover as investor confidence returns

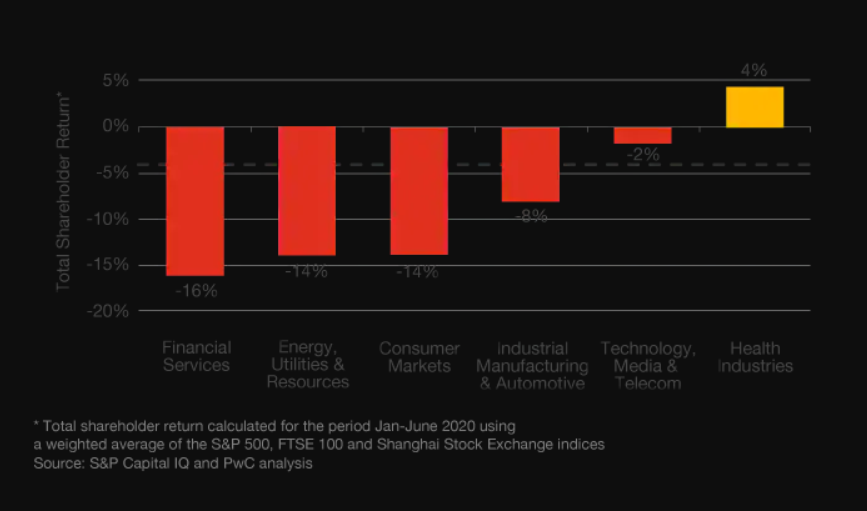

Most industries and regions are now seeing lower share-price volatility than in March and April, and the upward trend of major indices suggests investor confidence is returning. While several major indices are now only slightly below pre-COVID-19 levels, others have surpassed previous records. A comparison of the total shareholder return by an industry of the S&P 500, FTSE 100, and Shanghai Stock Exchange for the first six months of 2020 shows how performance has varied widely, both by region and by industry.

Total Shareholder Return by Industry, Jan-Jun 2020

The Nasdaq Composite fell close to 25% between 1 January 2020 and its lowest point on 23 March 2020. However, demonstrating the resilience of the technology sector, the index went on to reach successive all-time highs, ending June at 12% above where it started at the beginning of the year. While the recovery in valuations may hinder some take-private deals, this confidence bodes well for other forms of dealmaking.

Turkey’s natural gas find to fuel financial markets in midterm

Private equity at the ready

We initially expected private equity (PE) firms to capitalize on lower valuations through public to private transactions, but the rapid recovery in equity markets closed this window too quickly for most to execute. PE, with its US$1.5 trillion of dry powder, nonetheless remains ready to act, with particular focus on the many companies trading at significant discounts, despite the broader recovery of the indices.

PE firms and their portfolio companies came into the crisis riding a decade-long wave of growing transaction volumes, valuations, and fundraising. That position of strength may prove a bulwark in the months ahead, especially for firms that have exercised prudence recently.

We anticipate that across industries, small- to mid-size businesses with less robust cash positions will struggle as government support dries up, presenting opportunities for PE funds to consolidate and professionalize industry niches.

The situation for private equity will remain fluid, but we know with certainty those firms well-positioned to execute through-cycle M&A strategies quickly will be able to deliver more value for shareholders, employees, customers, and the communities in which they do business.

Will Jackson-Moore – Global Private Equity, Real Assets and Sovereign Investment Funds Leader, Partner, PwC UK

M&A looks set to rebound ahead of the global economy

The apparent disconnect between the economy and soaring financial indices has led many to question the sustainability of the rally; we believe M&A activity can lend credibility to the longer-term sustainability with well-thought-through deal valuations based on robust strategic analysis. Dealmakers will price the relative risks and opportunities within each industry and successful transactions will demonstrate greater confidence in the market.

U.S. Companies Vie for Funds in Race to Build Rare Earths Industry

Companies that approach M&A as part of a long-term strategic plan will be in a better position to capitalize on the opportunities presented in this challenging climate. In addition, history shows that those who engage in M&A early in periods of economic uncertainty see higher average returns than those who wait.

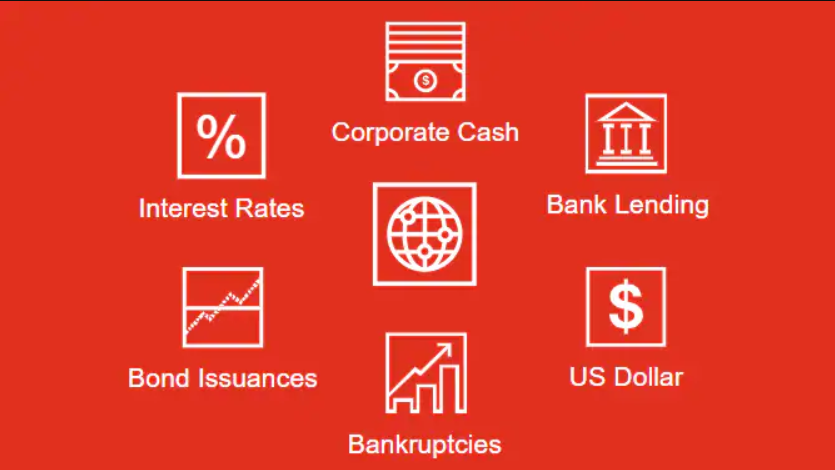

Several important indicators are flashing green for a jump-start in new M&A activity:

- Interest rates are at historic lows.

- Record levels of corporate cash and private market capital.

- Banks are beginning to lend again and alternative capital sources are available.

- Liquidity in bond markets has returned and new issuances have increased.

- Bankruptcies and the number of distressed companies are likely to rise, especially as government support programs expire.

- A strong US dollar promotes international opportunities for US investors.

Despite these strong fundamentals, volatility appears to be here to stay. Current COVID-19 cases continue to increase in many territories and fears of a second wave remain ever-present. Companies and investors are closely assessing the underlying business impacts, however, it is unclear what the long term effect will be on financial markets and CEO confidence. Additionally, the forthcoming US elections and global trade relations are casting further uncertainty over the future.

Markets will also continue to be affected by wider global megatrends. We have already seen convergence across industries as technology continues to disrupt and fundamentally change many business models. Multinational organizations will also need to learn how to navigate in an increasingly localized world. There is a definite opportunity for companies to seize the moment and use M&A to rethink and adapt their long-term strategy.

M&A strategy with a value creation mindset

Companies will need to repair, rethink, and reconfigure their businesses. The initial focus has been on the recovery of lost revenue, responding to operational disruption, and protecting the safety of employees and customers. In the rethink phase, senior leaders are considering strategic capital allocation and reviewing what constitutes their core business. We anticipate businesses will engage in M&A with a value creation focus as they reconfigure their operations and look forward to the long term.

Successful dealmakers understand the importance of staying true to their long-term strategic intent. PwC’s “Creating Value Beyond the Deal” series shows 86% of buyers surveyed who said their latest acquisition created significant value went on to state that it was part of a broader portfolio strategy rather than opportunistic.

The private equity industry is still fairly young, though old enough to remember 2008. Two aspects of how the industry confronted the last economic downturn show what may drive value in this one. Buying low is great if you can and it also aligns with strategy; those investors who have a value creation focus tend to outperform.

The value gap created by COVID-19 means that an end-to-end value creation approach to M&A is more important than ever before.

Malcolm Lloyd – Global Deals Leader, Partner, PwC Spain

M&A trends in the first half of 2020

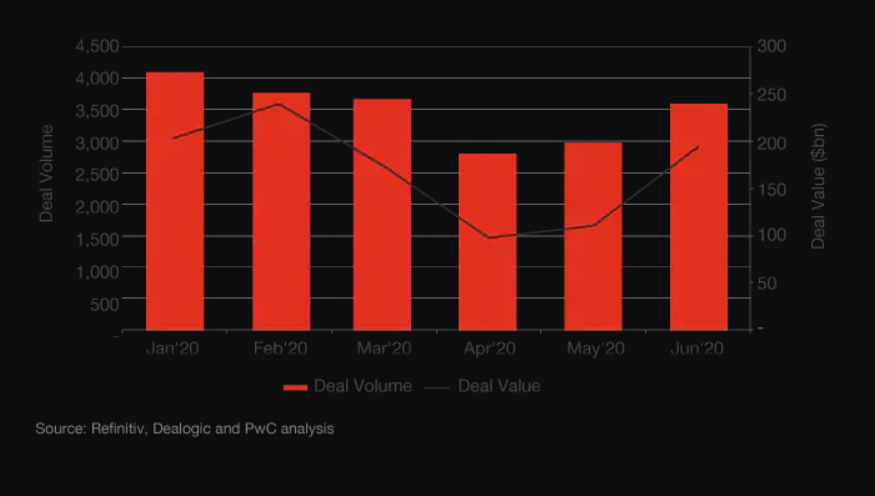

Global Deal Volumes and Values, Jan-Jun 2020

Heading into 2020, M&A activity was expected to decline from 2019 levels, mainly due to rising uncertainty around the global economy, trade tensions between the US and China, and the forthcoming presidential election in the US. The impact of the coronavirus then checked new M&A activity causing deal volumes to decline by 13% in the first half of 2020 versus the first half of 2019.

However, there are already signs that by the end of 2020 we will see a robust recovery in M&A activity. Deal volumes in June increased over April and May levels as many deal processes that were put on hold in the midst of the COVID-19 crisis resumed.

The technology sector has been the most resilient with tech deals leading the way and digital acceleration driving convergence across industries.

Brian Levy Global Deals Industries Leader, Partner, PwC US

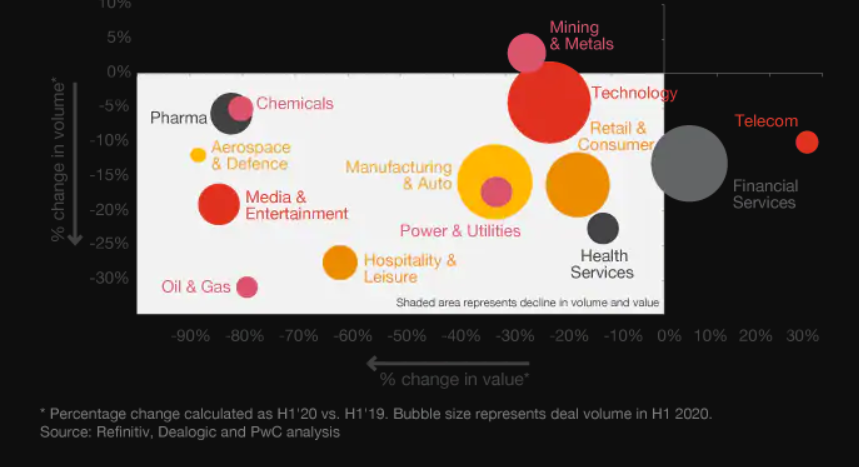

Deal values also fell during the first half of 2020, but by a much greater degree. Deal value trends varied widely by the industry as Aerospace & Defence declined by almost 90%, whereas Telecommunications increased by close to 30%. Unsurprisingly, the number of megadeals declined sharply, and deals announced in the second quarter tended to be smaller, more strategic bolt-ons and tuck-ins financed from corporate balance sheets.

Geographically, overall deal volumes and values across the Asia Pacific remained more resilient than in other regions since their economies were the first to reopen as COVID-19 restrictions eased.

PWC / Balkantimes.press

Napomena o autorskim pravima: Dozvoljeno preuzimanje sadržaja isključivo uz navođenje linka prema stranici našeg portala sa koje je sadržaj preuzet. Stavovi izraženi u ovom tekstu autorovi su i ne odražavaju nužno uredničku politiku The Balkantimes Press.

Copyright Notice: It is allowed to download the content only by providing a link to the page of our portal from which the content was downloaded. The views expressed in this text are those of the authors and do not necessarily reflect the editorial policies of The Balkantimes Press.