Egypt’s eternal gas dreams are back again on the drawing table.

In the last weeks, international gas markets have been very volatile, mainly due to the unexpected price volatility in Asia, pushing prices up to record levels but slowly coming back to reality. At the same time, even when some financial institutions are warning that natural gas is history, due to energy transition changes, global demand is strong, with more positive demand issues than threats on the table.

To access some of these new demand forecasts, Egypt, one of Africa’s leading gas producers, is stepping up its efforts to take part in the expected revival. After a detrimental 2020, when Egypt’s LNG exports were hitting rock bottom, the country now seems to be able to reap some rewards from its vast and very attractive offshore natural gas reserves. In a move to benefit from a future demand growth, LNG exports already have resumed from its Idku LNG liquefaction plant.

Most of the current LNG exports are going to Asia, mainly China and India, but even Turkey is a strong customer. News also has emerged that additional LNG exports are planned, as Egypt’s Damietta LNG liquefaction plant is also to restart end of February. The latter has been sitting idle, mainly due to commercial and financial issues since 2012.

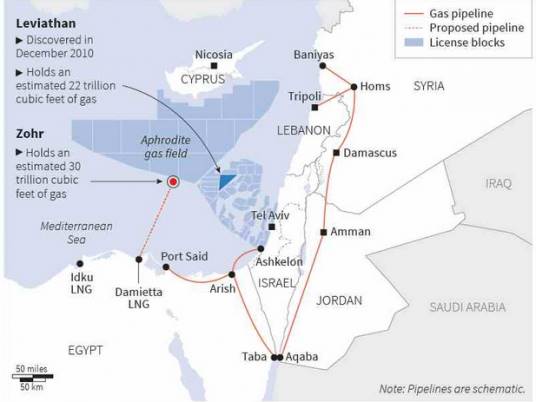

The immense offshore gas finds in the East Med, especially the elephant Zohr gas field, combined with other Egyptian discoveries and potentially Israeli offshore, are fully capable of pushing Egypt again up in the LNG exporters league, where it belongs.

LNG exports are needed in Egypt, not only to relieve some of the glut pressures on the local markets but also to monetize its natural resources to counter again growing government budget deficits. Another main threat to local gas demand is the growing impact of renewable energy projects in the country, removing part of the expected gas demand in the future from power generation.

Saudi steps up the renewables-hydrogen drive. Kingdom has to mitigate Germany’s Icarus experience!

In a remark made by Egypt’s minister of petroleum El Molla, the latter reiterated that LNG export expansion plans are in place, but will be formed by the market fundamentals and price settings in the coming months. Even that Asian LNG demand spiked unexpectedly, market fundamentals are still relatively weak.

The International Energy Agency (IEA), the energy watchdog of the OECD countries, has warned that the Asian situation is not an indicator that that global demand will rebound in 2021. The IEA expects only a small recovery in global gas demand this year, after the decline in 2020, partly due to the pandemic.

Still, East Med offshore gas reserves are not stranded, even that some analysts are worried about their respective commerciality. The still ongoing discussions and political framing of the East Med Offshore Gas Pipeline project, a multi-billion deepwater gas pipeline connecting Israeli offshore with Greece, via Cyprus, is a dream build on wrong propositions.

The staggering costs and technical challenges, while connecting the gas volumes to a single European outlet, is very tricky. To connect offshore East Med should either be done via LNG (or Small-Scale LNG) or target the Turkish market too. The only other option is to utilize the gas molecules inside of the region as feedstock for the still relatively small petrochemicals industry.

Even new entrants to the region, such as Chevron and others, are open to connecting offshore East Med to Egypt’s existing LNG gas infrastructure and outlets.

Last week, US major Chevron announced that, after it acquired Noble Energy and its interests in the region in 2020, with Delek and their partners in Israel’s Leviathan and Tamar gas fields, it now targets to set up an offshore pipeline infrastructure to link it to the Egyptian side too. As its Israeli partners acknowledged, the pipeline will connect facilities at the Israeli city Ashod to the EMG pipeline at Ashkelon, enabling Chevron and its partners to increase gas exports to Egypt to as much as 7billion cubic meters per year.

The latter could be part of an existing agreement in which Israeli partners will export as much as 85bcm/yr gas to Egypt over a 15-year-period. Gas supplies from Israel to Egypt started in January last year. Looking at the current natural gas glut in Egypt’s local markets, the only real commercial part would be to link it to Idku and Damietta’s LNG export outlets.

For the other East Med partner, Cyprus, these developments show that they should reconsider their own gas strategies very soon, and have a more effective look at the Egypt LNG option too. Energy companies have ramped up gas investments in the eastern Mediterranean in the past decade. San Ramon, California-based Chevron bought Noble Energy Inc. for about $5 billion last year, in large part to take on its interests in Leviathan, Israel’s biggest field, and Tamar, the second-largest.

Some analysts are warning that Egypt and East Med LNG are looking at the threat of becoming stranded assets, as the EU is not needing additional gas supplies. When looking at the statement made by Catharina Sikow Magny, Director DG Energy European Commission (EC), during last week’s European Gas Virtual conference, the threat is real.

She stated that the EU will need ZERO gas in the future. The latter statement was linked to the fact that the EU committed to net zero emissions by 2050, by then there will be zero unabated gas consumed in Europe. This should however be taken with a VLCC filled with salt. At present, demand for gas is more likely to increase than to decrease.

Whichever Green Deal will be put in place, financial backing for all will be the real issue, in light of the post-COVID economic situation. Additionally, all European examples at present, German EnergieWende or the Dutch strategy to take houses from natural gas supplies, has been backfiring or was a real debacle. Demand for gas is strong, not increasing but expected to plateau for longer.

At the same time, mainstream supply has been falling, especially indigenous gas production from Groningen (NL) or other places. Additional security of supply is needed, East Med is a prime option, also to hit on Russia’s stranglehold or Turkey’s energy hub position.

In the coming year, Egypt will be reaping the reward of all. The country expects, as stated by El Molla, that the Damietta facility will handle about 4.5 million tons of LNG annually, which will raise Egypt’s production capacity to 12.5 million tons. As stated before, Damietta was idled in November 2012 amid a dispute over gas supplies between the government and Union Fenosa Gas, a joint venture between Spain’s Naturgy Energy Group and Italy’s Eni. Egypt also is planning to increase its overall natural gas production soon.

In the next two weeks, Egyptian state firms EGPC and EGAS will offer onshore and offshore exploration blocks for bids from energy companies, El-Molla said. At the same time, El Molla has inked a new production sharing contract between the state-owned Ganoub El-Wadi Petroleum Holding Company (Ganope) and Shell Egypt to explore for oil and natural gas in the deep waters of the Red Sea.

According to the agreement, Shell Egypt will explore in the Red Sea’s Block 4, an area of 3084 sq km, Shell Egypt said in a statement. Shell Egypt acquired 63 percent equity share, Emirati Mubadala Petroleum 27 percent share, and Egyptian Tharwa Petroleum Company 10 percent of the contractor’s share, states the contract. The main focus will be natural gas production.

Shell Egypt has conducted several exploration missions in Egypt’s deep waters, such as the West Delta Deep Marine Phase 9B project. In 2018, the Egyptian Natural Gas Holding Company held an international bid for oil and gas exploration in which Shell Egypt was granted exploration rights in blocs 4 and 6.

Balkantimes.press

Napomena o autorskim pravima: Dozvoljeno preuzimanje sadržaja isključivo uz navođenje linka prema stranici našeg portala sa koje je sadržaj preuzet. Stavovi izraženi u ovom tekstu autorovi su i ne odražavaju nužno uredničku politiku The Balkantimes Press.

Copyright Notice: It is allowed to download the content only by providing a link to the page of our portal from which the content was downloaded. The views expressed in this text are those of the authors and do not necessarily reflect the editorial policies of The Balkantimes Press.