Risks increasing while prudent strategy missing in the case of China?

The world’s largest oil company Aramco has reported a 44% fall in revenues, reportedly caused by COVID-demand destruction and lower oil prices. Saudi national oil has had a rough year, as it also had to navigate a very turbulent oil market while trying to re-establish its position as the global swing producer.

The profit however is still much higher than its independent competition, as Aramco still shows green figures after 2020, while Shell, BP, or ExxonMobil needed to report not only red figures but also have been forced to divest major oil and gas reserves.

While being hit by the global pandemic, Aramco still keeps its optimism, as its CEO Amin Nasser sees already light at the end of the tunnel. The Aramco official expects global oil demand to reach 99 million BPD at the end of 2021, while 2022 could be very positive.

At the same time, Aramco is linking its future to Chinese oil demand, as Nasser reiterated by stating that Saudi Arabia will be supporting and guaranteeing Chinese energy security to 2050.

With a whopping 44% decrease in net profits, reaching only $49 billion in 2020, some critical thinking should be put in the minds of the Saudi leadership.

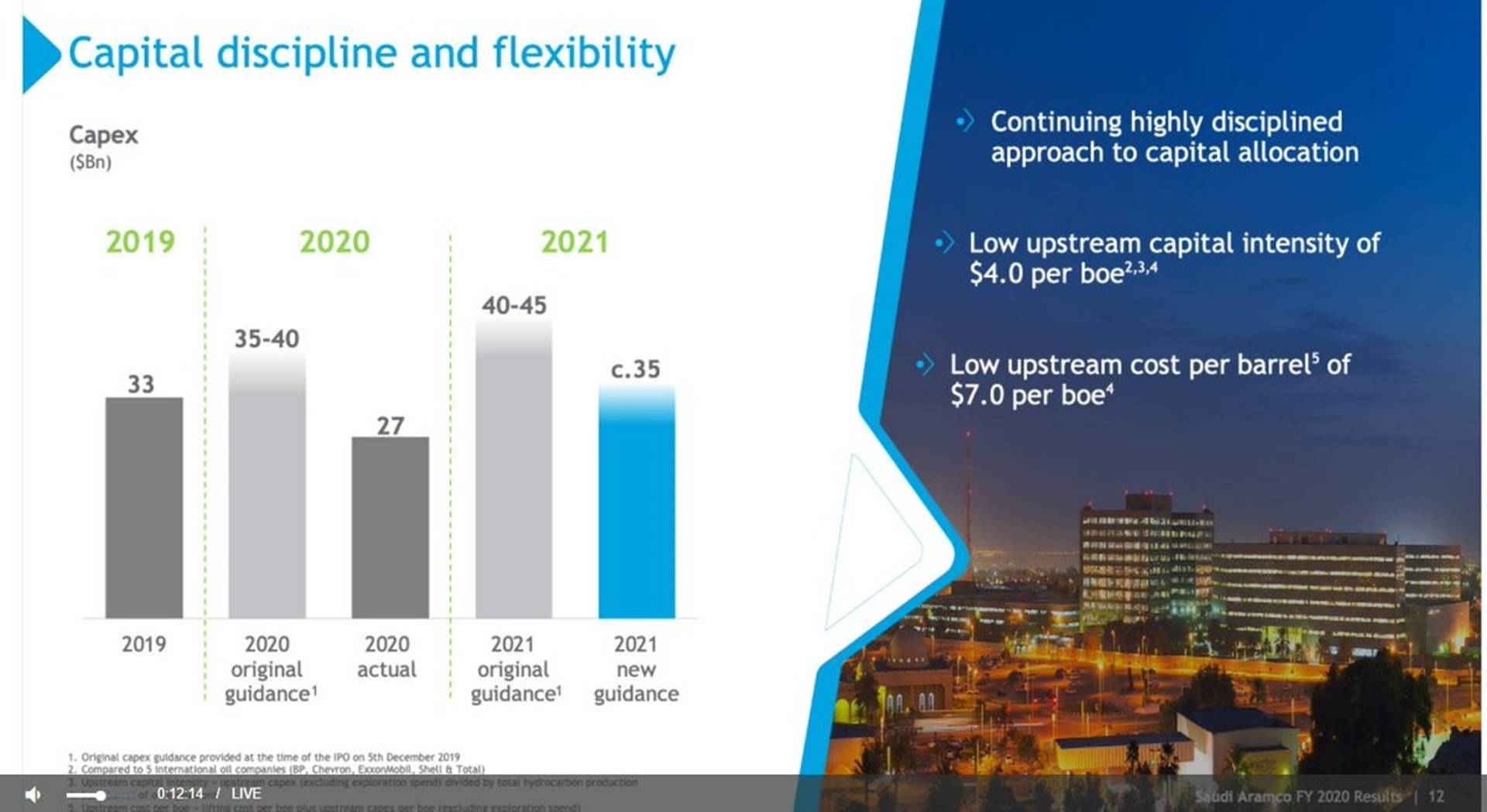

As the company not only has reiterated that it will be spending less in 2021 than the year before, critical aspects of the future operations of the national oil (and gas) giant could become hampered. With a CAPEX of around $35 billion for 2021, Aramco has clearly decided to spend even less than the market was expecting, based on the company’s former guidelines.

The market expected a CAPEX of between $40-45 billion but is now confronted by a steep decline again. These negative developments stand in stark contrast to the “stubborn” position the oil giant takes with regards to its dividends.

Aramco keeps its $75 billion dividend payments in place, but critical assessments about this continuation will be expected soon.

Still, some worrying developments are under-assessed also. When assessing the overall performance of its competitors, analysts are increasingly worried about debt levels and investment volumes. The same prudent approach should be used with Aramco, as its profit margins or dividends seem to be fogging up analysis of its overall debt levels. In comparison to 2019, the overall debt level of Aramco has almost quadrupled, which is normally a warning sign for investors and analysts.

Profit margins of upstream are still very attractive, but as some have indicated already Aramco’s downstream is being hit for consecutive years with less promising figures, while investments are still targeting major expansions.

The optimism currently shown by Aramco officials, especially its CEO Amin Nasser, should however not only be seen as a pure economic indicator, but also in light of the fact that Aramco is not only an internationally listed national oil company but also still a direct instrument of Saudi’s national government.

The position taken by Nasser should be assessed not only as being the CEO of Aramco but also as representative of the Riyadh government, which is still, even that Saudi Vision 2030 is progressing, the main current and future revenue generator of the country.

Optimism is needed in the Aramco statements, as a slight shift in sentiment shown by Saudi officials, will be enough to rock the still very weak sandcastle called the global oil market.

While already hundreds of analysts and media articles were analyzing a new or the last “super-cycle of commodities”, the reality is hitting back as oil prices have again plunged, as fundamentals are still weak.

The latter also should be on the mind of Aramco and Saudi officials when linking the Kingdom’s future to China’s energy thirst or commodity intensity. For the first couple of years, all signs are still on green for Saudi oil exports to China, but if Beijing’s plan-economy is really changing, renewables or net-zero practices will be biting severely into Saudi oil and petroleum products exports to the Asian Tiger.

From an investor’s or even “normal independent” oil company’s strategic view spreading risks at present should be a major undercurrent.

Looking at least the official statements made, Saudi Aramco is looking as if it is putting all its eggs in one big basket. To rely on and to link its future (next 40 years) to Chinese demand and economic growth is a very risky one.

Spreading risks would be a much more prudent approach, looking at growing discrepancies between Chinese global views, economic strategy and targets, and the Arab world.

The main question to be asked by analysts should be why is there not a risk-averse strategy towards Asia or at least with regards to China.

OPEC and non-OPEC allies to review oil production cuts after dire demand warnings

Another major Asian tiger, India, within the future more potential than the Chinese, which is almost overlooked. Looking at the current investment strategies of Aramco, India is not on the most wanted list to invest or set-up JVs.

Spreading your risks by leaning towards (blue) hydrogen is also a very risky one, as nobody, also not mainstream analysts in Saudi quarters, know the success or potential of hydrogen in the next decades.

Again, even with a still very green financial report over 2020, the future is not at all clear for Aramco. Geopolitics and geo-economic factors and changes seem not at all being factored in.

To count on a Chinese global hegemony seems to be very one-sided, especially if China is not at all showing a full-scale Saudi approach when importing oil and gas, or investing.

Additionally, some forget another major risk in place, regional and geopolitical developments. As a national oil company, Aramco is constrained by its geography and reserve potential singularity. In contrast to major international oil companies, which have a vast and diverse reserve potentially spread over a wide range of basins, Aramco’s main producing areas are all in a very volatile region.

Geography is putting risk in place, as both outlets of Aramco’s crude oil and products are confined to the Arabian/Persian Gulf and the Red Sea. These two maritime outlets are increasingly under pressure, due to geopolitical risk profiles, such as the militarization of the Red Sea.

Crude to $100: Dealer makes the case for a spike in oil costs

If an international oil would be confronted by major unrest or threats to its production, such as Shell/ENI in Nigeria, or BP in Russia, investors are worried or even abandoning ship.

The increased attention of Iranian proxies or Houthis for Saudi oil and gas infrastructure, as seen in the last weeks, is another warning that should be heeded.

Missiles and drones are not the ingredients for a healthy breakfast. Aramco’s listing on the stock exchange, especially if Saudi Crown Prince Mohammed bin Salman’s statements to sell more shares in the coming period, should be taking these potential dangers into account.

Internally, Aramco’s financials are still linked to the future of the Kingdom and its economic diversification strategies.

The need for cash is high, dividends are seen as the reason to invest in Aramco, so there will be a possible crash situation in which one or the other will need to budge. Saudi strategic assessments will lead in this!

The current optimism could quickly change, due to lower demand and prices. At the same time, to keep up its pivotal role in global oil markets, which is the cornerstone of Aramco and Saudi Arabia’s prominence, more investments are needed. Competition is already looking for blood, while Arab compatriots are engaged in targeting production increases very soon.

Napomena o autorskim pravima: Dozvoljeno preuzimanje sadržaja isključivo uz navođenje linka prema stranici našeg portala sa koje je sadržaj preuzet. Stavovi izraženi u ovom tekstu autorovi su i ne odražavaju nužno uredničku politiku The Balkantimes Press.

Copyright Notice: It is allowed to download the content only by providing a link to the page of our portal from which the content was downloaded. The views expressed in this text are those of the authors and do not necessarily reflect the editorial policies of The Balkantimes Press.