Comparing 2009 ARPA-E winners to peers yields a mixed bag. In 2009, the US Department of Energy started funding energy research through the Advanced Research Projects Agency-Energy (or ARPA-E) program.

The goal was to take more risks than traditional federal efforts and help new renewable energy technologies get off the ground. Private investment had been flagging due to slow returns, but the huge societal benefit of clean energy was deemed to justify government support. The hope was that the funding could accelerate the timeline for new technology to mature to the point that private investors would find the technology more attractive.

At least, that was the idea. A team led by the University of Massachusetts Amherst’s Anna Goldstein figured that ARPA-E’s first class is now old enough to check in on. She and her colleagues looked at a limited sample of 25 startups and found some interesting ways in which these companies seem to have beaten out the competition—and some in which they haven’t.

Netflix’s Away splendidly brings a humans-to-Mars mission to life

Best in class

The 25 startups selected in ARPA-E’s first-round were compared to several other groups of companies that were born around the same time. The first group consists of the 39 companies that applied for ARPA-E funding and didn’t get it but still received an “encouraged” runner-up rating. In the next group are the 70 companies that received funding from the Office of Energy Efficiency and Renewable Energy (EERE) with related government stimulus spending. And finally, there are almost 1,200 other clean energy startups that found their funding elsewhere.

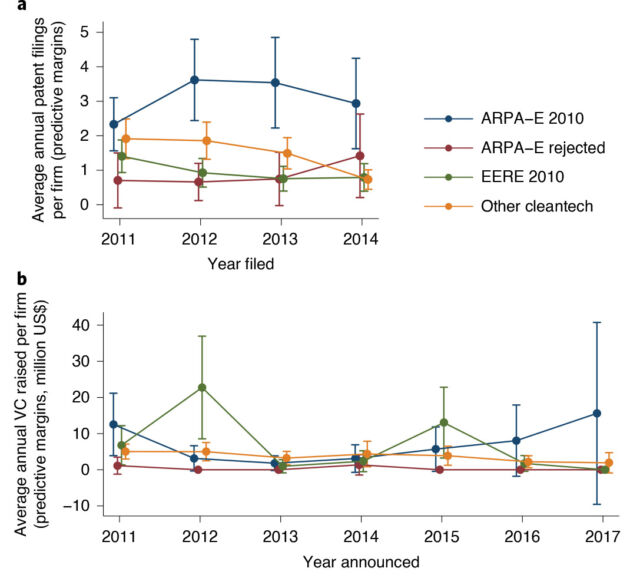

Each group was compared by the number of patents it has filed and by the amount of funding it has found since—either from venture-capital investors, acquisitions by other companies, or going public for stock investment.

Looking at patents, the ARPA-E winners enjoy a significant advantage over the other groups. About 80 percent of them have successfully filed at least one patent. Attempting to account for startup characteristics like pre-ARPA patent activity still shows that the winners filed patents at about double the average rate. This could be due to more than just the cash infusion. DOE project managers both work with and monitor the winners over time and maybe helping to guide companies through the patenting process. Companies also have an incentive to show progress to stay in the program, and patents are a good way to do that.

Things get murkier when the researchers look for proof that this led to success in securing additional funding. The ARPA-E winners were more likely to find funding than the ARPA-E near-misses, but differences with the other two groups of startups are small. When analyzing by each specific type of funding, the researchers see some potentially interesting numbers. The ARPA-E winners were slightly more successful at getting venture-capital funding, for example, but the difference is within the error bars due to the small sample size.

There are some obvious caveats here. It’s possible that some of the differences can be explained by ARPA-E selecting companies that were more likely to be successful, rather than the ARPA-E funding causing all the success. As the researchers point out, however, that wouldn’t necessarily detract from the program, as it would imply it was good at selecting the best startups. On the other hand, it could be that these were riskier startups that would have underperformed if not for the boost from ARPA-E.

Video: Elon Musk on Tesla Roadrunner Cell Leak: “It Will Be Very Insane”

There are also some differences in the types of technology these startups were building. ARPA-E is intended to focus on technologies that are receiving less private funding, and it takes on more applicants within specific themes. That first class of ARPA-E applications had a much larger share of energy-storage startups than the overall group, which featured more solar and wind startups, for example.

With some signs of positive—but not overwhelming—success for the first group of ARPA-E winners, the researchers say there may be additional ways to maximize the program’s impact. They write:

It is not surprising if ARPA-E alone has not fully solved the “valley of death” problem for innovative cleantech companies, which has been shown to be especially acute in the demonstration phase,” they write. “Complementary innovation policies, such as increased funding for demonstration and commercialization, in-kind support from national laboratories and targeted procurement programmes, may be needed to allow scale-up beyond the R&D phase and to ensure that cleantech innovations can leverage additional private financing and transition to the market.

Arstechnica / Balkantimes.press

Napomena o autorskim pravima: Dozvoljeno preuzimanje sadržaja isključivo uz navođenje linka prema stranici našeg portala sa koje je sadržaj preuzet. Stavovi izraženi u ovom tekstu autorovi su i ne odražavaju nužno uredničku politiku The Balkantimes Press.

Copyright Notice: It is allowed to download the content only by providing a link to the page of our portal from which the content was downloaded. The views expressed in this text are those of the authors and do not necessarily reflect the editorial policies of The Balkantimes Press.