Fidelity leads a $376 million funding in Starling, valuing the United Kingdom virtual financial institution at $1.five billion

LONDON — Starling Bank, a virtual-simplest challenger financial institution inside the U.K., stated Monday that it’s raised £272 million ($376 million) in a funding round, reported CNBC

The sparkling coins injection, led via way of means of Fidelity Investments, values Starling at £1.1 billion, or $1.five billion. That lifts it into the ranks of Europe’s unicorn companies — privately-held companies valued at $1 billion or extra.

Chinese app Meitu buys $forty million really well worth of Bitcoin and Ethereum

Qatar’s sovereign wealth fund, the Qatar Investment Authority, additionally invested in Starling, together with U.K. pension scheme Railpen and hedge fund Millennium Management.

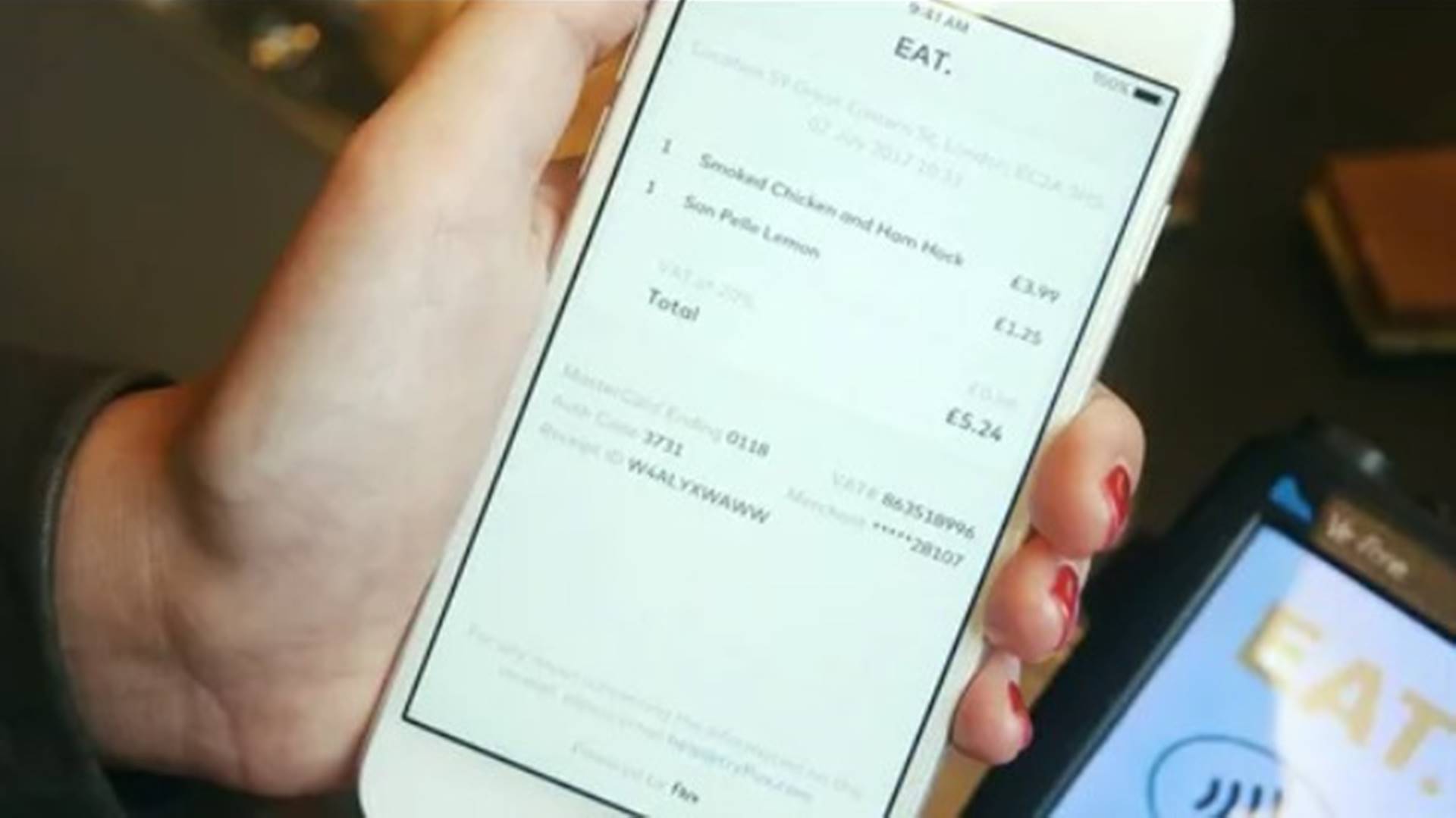

“Digital banking has reached a tipping point,” Anne Boden, Starling’s CEO, stated in an announcement Monday. “Customers now anticipate a fairer, smarter, and extra-human opportunity to the banks of the beyond and that’s what we’re giving them at Starling as we keep growing and upload new merchandise and services.”

Havelsan’s upcoming attention to be virtual gadgets, trendy supervisor says

Boden added: “Our new traders will carry a wealth of revel in as we input the following level of growth, even as the continuing guide of our present backers represents a large vote of confidence.”

Starling stated it’d use the cash to amplify into Europe, and for expected mergers and acquisitions. The employer finally yr restarted talks to steady a banking license in Ireland, after having to start with placed worldwide growth plans on maintain because of the coronavirus pandemic. Meanwhile, Boden has formerly expressed a hobby in shopping for a rival lender.

“We are in all likelihood going to gather something in the course of 2021,” Boden stated in an interview final yr. “Lots of creditors are going to reevaluate their destiny and we’re developing very, very fast. We’re continually searching out opportunities.”

Boden denied a file claiming that JPMorgan and Barclays had proven a hobby in shopping for Starling. She has formerly indicated the start-up might are looking for a preliminary public offering.

Starling is one of Europe’s maximum outstanding virtual banks. Founded in 2014 via way of means of Boden, a former banking executive, the organization has attracted 2 million customers and now money owed for five% of the U.K.’s small enterprise banking market, with 300,000 small enterprise clients.

While home rival Monzo has floundered, with its valuation losing 40% final yr amid the coronavirus pandemic, Starling has controlled to attain something many Fintechs have struggled with: to attain profitability. The employer eked out earnings of £800,000 in October and says it’s been always worthwhile since, with internet earnings now exceeding £1.five million according to month. The employer says it’s now in the direction to file its first complete yr of earnings.

Starling was given a large raise from the U.K.’s coronavirus lending schemes, becoming one in every of numerous fintech companies to provide government-subsidized loans to businesses in the course of the pandemic. It now has gross lending of extra than £2 billion and deposits of £five. four billion.

Napomena o autorskim pravima: Dozvoljeno preuzimanje sadržaja isključivo uz navođenje linka prema stranici našeg portala sa koje je sadržaj preuzet. Stavovi izraženi u ovom tekstu autorovi su i ne odražavaju nužno uredničku politiku The Balkantimes Press.

Copyright Notice: It is allowed to download the content only by providing a link to the page of our portal from which the content was downloaded. The views expressed in this text are those of the authors and do not necessarily reflect the editorial policies of The Balkantimes Press.