OPEC’s leader Saudi Arabia currently is looking at positive media coverage, as long as oil prices are perceived to go up higher, revenues are going to increase

OPEC’s leader Saudi Arabia currently is looking at positive media coverage, as long as oil prices are perceived to go up higher, revenues are going to increase and unexpected success stories of Saudi Vision 2030 continue.

It seems that the main Arab Gulf economy is heaving all wind it needs in its sails to reach targets very soon. Additional support is expected still from global financial markets, as the Kingdom is almost able to get its money for free.

This unexpected windfall is a major boon for Saudi Crown Prince Mohammed bin Salman’s (MBS)’s economic diversification plans, as not only the future of the Kingdom depends on it but also the future career of the charismatic young Arab leader. Current results are more than able to counter growing American or Western pressures with regards to his perceived link to the killing of Saudi journalist Khashoggi.

Saudi steps up the renewables-hydrogen drive. Kingdom has to mitigate Germany’s Icarus experience!

The still very diffuse and rather subjective recordings in the US intelligence report several weeks ago have put still some worries in the mind of the Saudi elite, but….money also here makes the world spinning around. Sentiments can be changed, as is shown in all Arab countries.

Commercial deals, business links, and the growing international stature of the Saudi Crown Prince make it possible to shrug off criticism in Washington, Canada, or Germany. Still, there are major cold fronts building up behind the horizon if financial figures are taking into the connotation.

As stated in the last few days, Saudi Arabia has re-entered in full force international money markets, putting several new diamonds on its already impressive financial necklace.

Saudi ban on Turkish industry harms EU, US-diversified supply channel efforts

The main stories currently being published are related to the Saudi sovereign wealth fund Public Investment Fund (PIF), which some see as the weaponized financial instrument of the “King-to-be”. MBS has been able to understand the potential of the former rather defunct SWF by pushing it up to levels unforeseen.

Even that the PIF was promoted at the Future Investment Initiative (FII) 2016 as the bulwark of the new Saudi Vision 2030, skepticism was high, as success was not imminent.

Since 2016 the PIF however has become one of the world’s leading SWF, not only due to its ownership of ARAMCO and SABIC but also by being the driving force behind Saudi’s GIGA projects Qiddiya, Alaama, Red Sea Islands, or the City of the Future NEOM.

Until now, success has been hiding some of the troubles ahead it seems. Due to the immense success, in stark contrast to Western media’s expectations, of the Aramco IPO, the integration with SABIC, and the set up of a long list of other projects, targeting infrastructure, ports, IT/high tech or defense, small dark clouds were removed by the immense intensity of the success stories.

Saudi Arabia scraps VAT on property deals introduces lower tax to boost the market

High-profile projects and high-flying sports and music events blocked the view of other issues. Higher oil prices lately again have driven trouble-spots into some dark rooms, hidden for the majority of observers. Behind all the bright stars on the Saudi firmament financial troubles could be the next phase to discuss.

Even that international financial institutions, banks, investors, and hedge funds are rolling over to provide cash to the Kingdom, the other side of the coin is worrisome.

The Kingdom of Saudi Arabia is piling up a mountain of debt, which has never been as high before. Since 2015 Saudi Arabia has already piled up an additional $200 billion in debt, from banks or global bond markets. Due to overwhelming interest from the financial world and the need to counter lower oil revenues and higher government spending, the Kingdom’s Praetorian Guard has been opening the doors for debt.

At present, even at current prices ($70 per barrel), government budget deficits are increasing. The budget cannot be sustained at current levels if prices would plunge again.

Some will argue that, based on a Keynesian economic view, debt is the only option to wain the Kingdom of its oil addiction. MBS’s extraordinary, and mostly right plans, to overhaul the current hydrocarbon-based rentier-state economy needs cash. Economic diversification will not be cheap, even if at current price settings money has never been cheaper.

Saudi appetite for new cash influx or higher debt levels is still very high. In the last few days, Saudi Arabia has again entered financial markets, when the PIF took out another US$15bn facilities. This is a vast amount, but still, more is needed as Saudi Vision 2030 plans have been talking about investing more than $4 trillion to get the Kingdom into the 21st AND 22nd Centuries. The money came from a 17-strong syndicate of banks.

In stark contrast to normal SWFs, the PIF has been behaving like a bank, equity fund, or semi-governmental financial institution, not only relying on its $400bn of assets but also on its power to borrow cash. The Saudi SWF has made it clear to the market that it will be hitting even more global markets as it needs additional volumes of cash to finance its strategic plans.

PIF has already been able to reap the reward of a $40 billion transfer by the government to take part in a major share buy program when international shares plunged due to COVID. Major share packs have been acquired of Boeing, Disney, Shell, and others, and profits already are recorded. This however was a one-off, Riyadh is now sitting more on its own cash, so other options are needed.

Until now the PIF has taken out two loans, one $11 billion five-year facilities in 2019, and the current $15 billion. Other options are not yet considered, the market expects the PIF now to enter in full force international bond markets.

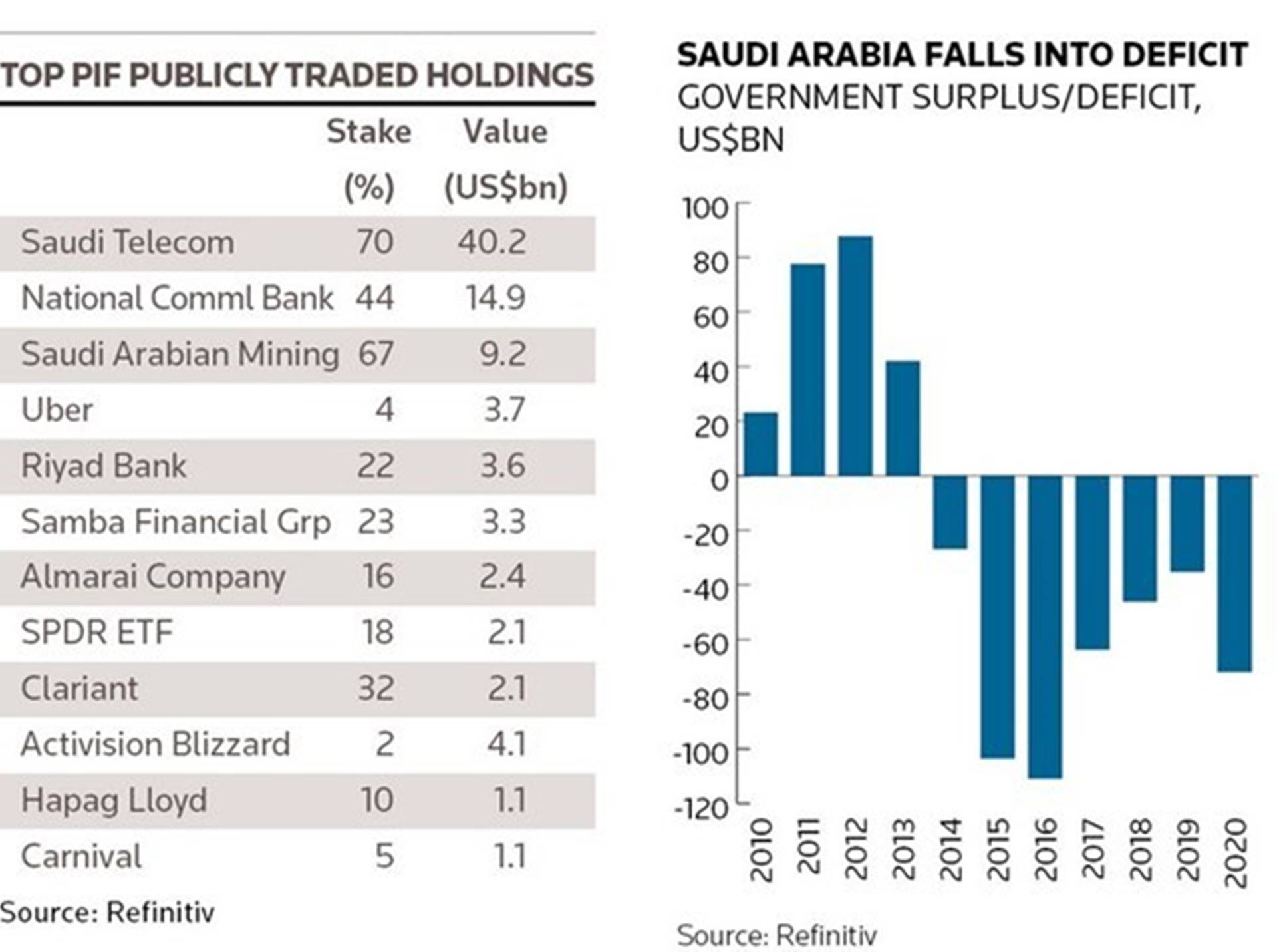

Analysts however are warning that before the PIF is able to access the bond market, major steps need to be made. The main focus before will be the need for the PIF to give a breakdown of its $400 billion assets. At present, based on national and international legislation, only $96bn of shareholdings have been declared, mainly in Saudi Telecom, National Commercial Bank, Uber, and Carnival.

Its well-known $45bn in SoftBank’s Vision Fund, which lost US$18bn last year, and JVs with Blackstone, Russia, and France, are known but details are missing. The latter could be a major constraint for the PIF, as bond managers are more eager to get more information before opening up. Some analysts expect that the PIF will be still very active inequities, as this could be financed together with private entities in Kingdom or elsewhere.

The above is still needed, as in general, the PIF has been tasked to bring Saudi Vision 2030 to success. Part of this will be to set up dozens of new companies, expand existing ones in defense, IT/high tech, or food, and in the next four years create 1.8 million new jobs. These targets are gigantic, and most probably still out of reach.

Success is needed but is not clearly available. At the same time, if there are hiccups on the financial side of targets, eyes will again be looking at oil revenues. With higher debt levels, and future expenditure plans gigantic, higher oil levels could be bringing relief. The latter is however not in the offing, as oil price levels of $125-150 per barrel are at present not going to be hitting markets very soon.

The Riyadh government will have to assess its options very soon, otherwise, debt levels are increasing to unsustainable levels, while social changes or economic growth is still lagging. The need for 1.8-2 million new jobs for young Saudis is a reality, how to get there is still a major question mark.

If not being successful, a criticism inside of the country’s elite (which is still under shock from MBS’s moves) and the Crown Prince’s real power base, the Young Saudis, will be a major issue to deal with. A dangerous situation could quickly emerge, in which outsiders will not be sitting still. For Saudi Arabia’s young prince the choices are clear, spent, and borrow as diversification is the key to survival.

Some analysts are optimistic about Saudi Arabia and the GCC as a whole. In the last few days, analysts indicated that the current oil price level the need to borrow is almost flat.

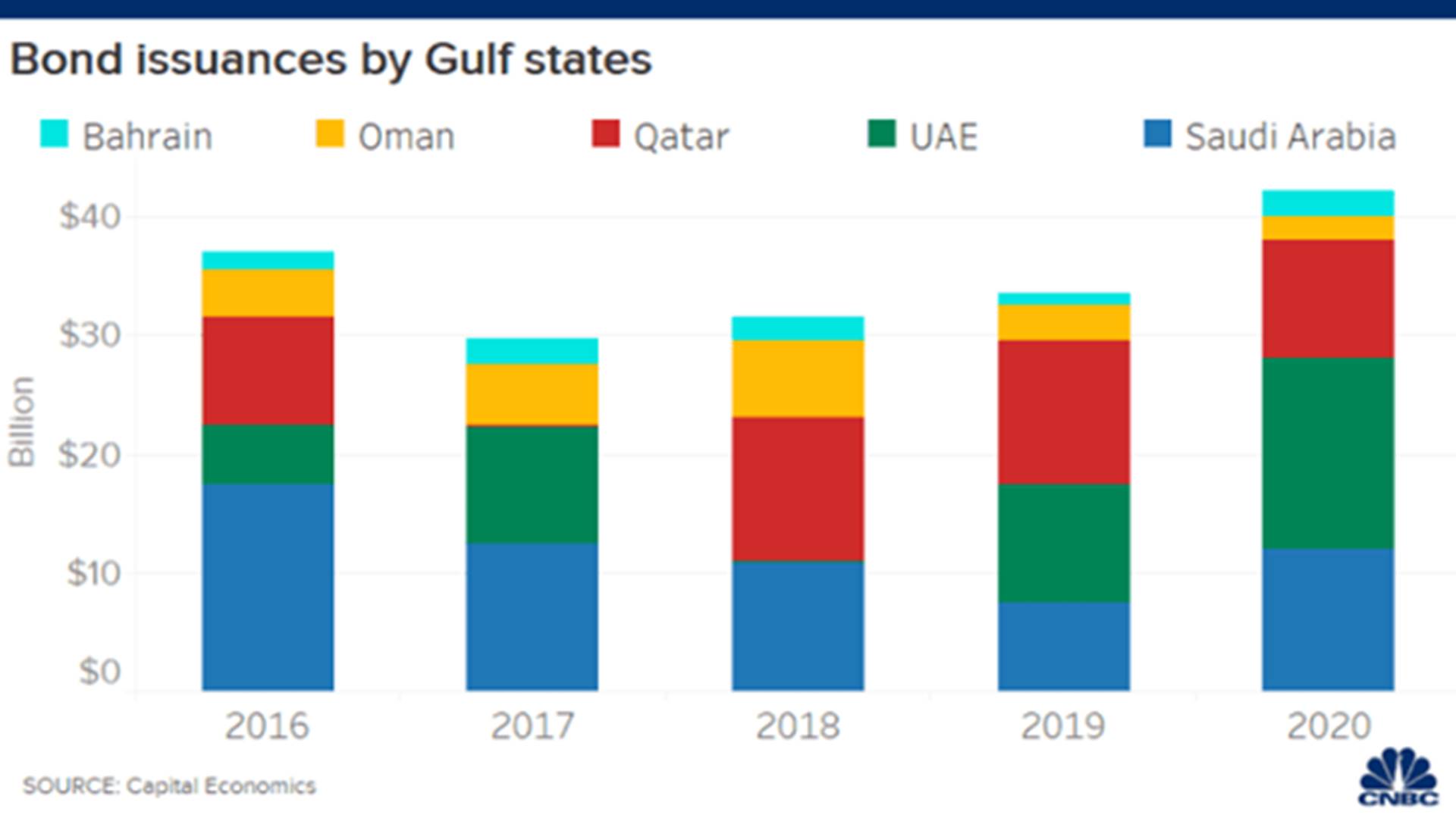

Revenues are almost enough to counter government budget requirements. GCC current accounts are slated to be needing price levels of around $50 per barrel. In how far debt levels and the need for diversification are taken into account however is not really clear. In 2020 Gulf sovereigns raised about $63 billion in bonds and Sukuk last year.

US banking giant Goldman stated that Kuwait is likely to have the biggest improvement in its budget balance from high oil levels, with its shortfall narrowing by around 15 percentage points of gross domestic product this year. When looking however at Saudi Arabia, Goldman indicated that over the next three years, Saudi Arabia’s net debt is seen rising to a “still manageable” level at 38% of GDP.

This is not a very high level when comparing them to OECD or EU countries, but still, it has grown exponentially. Saudi figures also become more clear when comparing them to Qatar, where the latter’s fiscal balance is seen swinging from a 5% deficit to a surplus of 5% of GDP.

According to Capital Economics, bond issuances by Gulf countries rose significantly in 2020. CE also stated that the total international debt issued by Saudi Arabia, the United Arab Emirates, Qatar, Bahrain, and Oman was $42.1 billion last year. That’s up 25% from $33.5 billion in 2019.

Mainstream analysis the last weeks has been cautiously optimistic. The main driver for this is however one large fundamental error. In almost all analyses crude oil prices and the related government revenues are expected to be up. Higher crude prices, caused by increased global demand, economic recovery in main markets, and tight government budgets at home, are seen as a recipe for success. The flaw however is straightaway in the expectations of higher crude oil (gas) prices.

No real fundamentals however are already in place to expect the latter. Current positive sentiment in the market is based on weak reports about successful COVID vaccines and expected holiday openings. At the same time, as shown by the AstraZeneca crisis in several EU countries, it is all still very fragile. Demand is not yet where it should be, while oil storage is still full.

To expect revenues to increase is very short-sided. To think that oil and revenues will continue to be enough to counter growing debt levels is also a weak approach. Multibillion investment schemes are planned, not only in Saudi Arabia but worldwide. At a certain point, the money will not anymore be free, and debt needs to be repaid. Living on perceived prosperity in the future is a tricky business.

Napomena o autorskim pravima: Dozvoljeno preuzimanje sadržaja isključivo uz navođenje linka prema stranici našeg portala sa koje je sadržaj preuzet. Stavovi izraženi u ovom tekstu autorovi su i ne odražavaju nužno uredničku politiku The Balkantimes Press.

Copyright Notice: It is allowed to download the content only by providing a link to the page of our portal from which the content was downloaded. The views expressed in this text are those of the authors and do not necessarily reflect the editorial policies of The Balkantimes Press.