Some 4.4 million Americans – or roughly 3 percent of all employed workers in the nation – quit their jobs in September, the US Department of Labor said on Friday

Some 4.4 million Americans – that’s 3 percent of all employed workers in the nation – quit their jobs in September, the United States Department of Labor said on Friday.

That was 164,000 more than in August and marked the second straight month of a record-shattering quits rate in the Labor Department’s Job Openings and Labor Turnover Survey (JOLTS).

There are millions of jobs, but a shortage of workers: Economists explain why that’s worrying

The quits rate is a barometer of workers’ ability or willingness to leave jobs. And job hunters certainly have plenty of breathing room to be choosy about who they work for, with the number of job openings in September little changed at 10.4 million.

Though lower than in July, when a record 11.1 million jobs went begging, job openings in September were still well above the pre-pandemic high of 7.3 million reached back in October 2019.

Shortages of workers and raw materials, as well as supply chain snarls, have become a hallmark of this year’s economic recovery.

Bosnia and Herzegovina: 110 multimillionaires and over 1.000.000 hungry citizens

The paucity of available workers has baffled many economists, because the US labor market is still 4.2 million jobs short of where it stood in February 2020 – right before the coronavirus pandemic struck.

Factors ranging from fear of contracting COVID-19 to childcare constraints to older workers opting to take early retirement thanks to swelling stock and home values have all been cited as possible reasons for keeping workers on the sidelines.

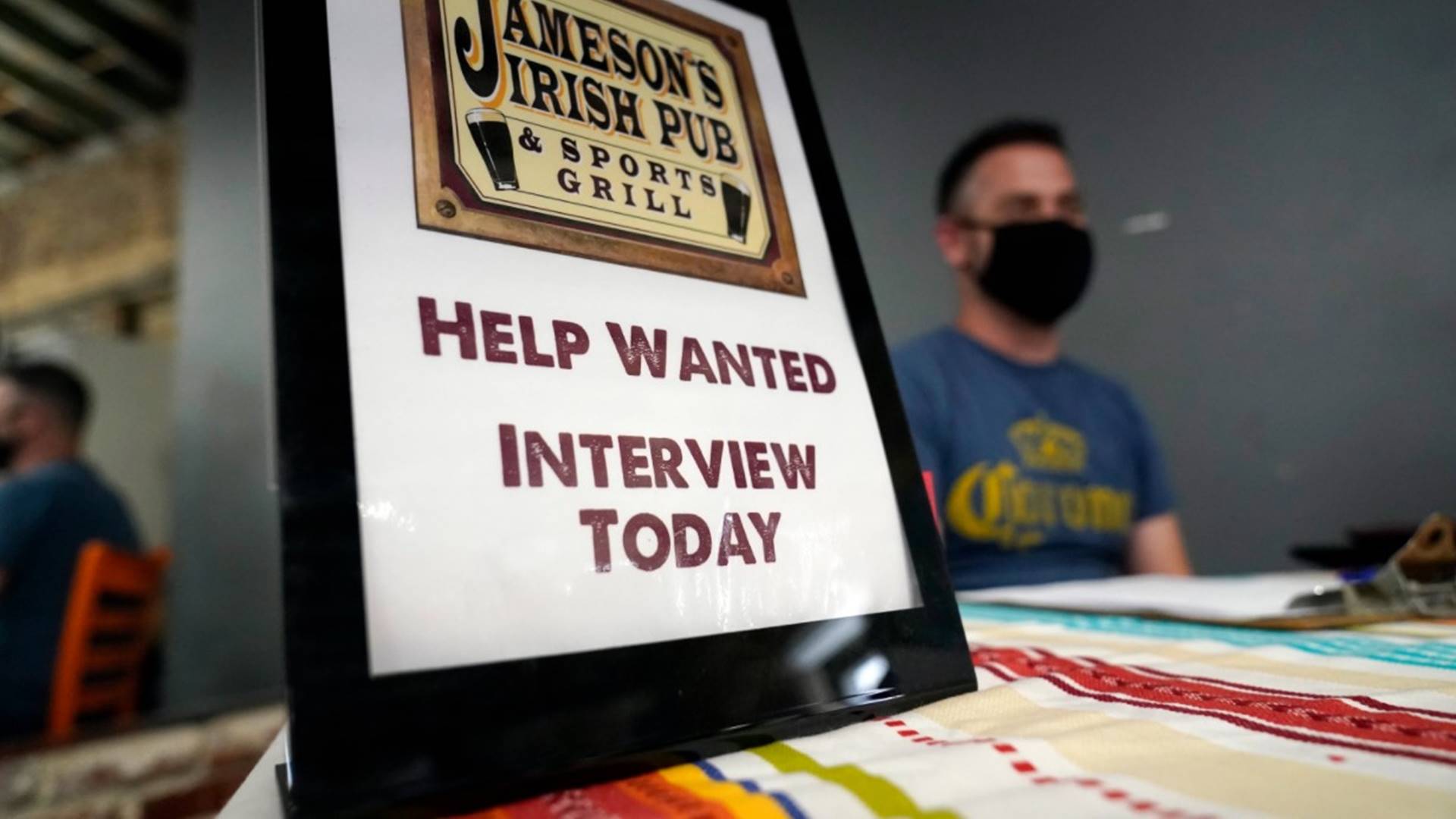

The increased competition for workers is especially tough on small businesses.

In October, nearly half of small business owners surveyed by the National Federation of Independent Business (NFIB) said they had job openings they could not fill and that they were less optimistic about future business conditions.

“One of the biggest problems for small businesses is the lack of workers for unfilled positions and inventory shortages, which will continue to be a problem during the holiday season,” said NFIB Chief Economist Bill Dunkelberg in a statement this week.

To entice job seekers, firms have been raising wages and offering more generous job benefits.

That was reflected in average hourly earnings, which jumped 4.9 percent in October over the year before.

Still, that pay bump is not keeping workers ahead of inflation. Because as businesses shell out more for workers and raw materials, those costs are being passed on to consumers.

In October, US consumer prices jumped a blistering 6.2 percent from the same period a year ago. That is the fastest pace in 30 years.

Leading the surge were energy prices, which were up 30 percent over the past 12 months. Prices of food and rents also increased sharply in October.

But some analysts see rising wages playing a bigger role in inflationary pressures in the months ahead.

“The September Job Opening and Labour Turnover survey shows labor market conditions are far tighter than the 4.6% unemployment rate suggests, and points to continued rapid wage growth,” said Capital Economics’ Senior US Economist Michael Pearce in a note to clients.

“With productivity stagnant, that will add to mounting cyclical price pressures, which we expect to take over from supply bottlenecks and energy prices as the key source of upward pressure on inflation next year.”

US consumers, meanwhile, are bracing for more pain in their wallets, with the most recent monthly survey of consumer expectations by the New York Fed showing median inflation expectations for the coming year have hit an all-time high.

Napomena o autorskim pravima: Dozvoljeno preuzimanje sadržaja isključivo uz navođenje linka prema stranici našeg portala sa koje je sadržaj preuzet. Stavovi izraženi u ovom tekstu autorovi su i ne odražavaju nužno uredničku politiku The Balkantimes Press.

Copyright Notice: It is allowed to download the content only by providing a link to the page of our portal from which the content was downloaded. The views expressed in this text are those of the authors and do not necessarily reflect the editorial policies of The Balkantimes Press.